57. Jimena Mora, CFA and Jack Wieters, CFA are economists for Otterbein Forecasting. Otterbein provides economic consulting and forecasting services for institutional investors, medium-sized investment banks, and corporations. In order to forecast the performance of asset classes and formulate strategic asset allocations, Mora and Wieters are currently examining the capital market expectations for four developed countries: Alzano, Lombardo, Bergamo, and Linden. Wieters was hired in 2009 and Mora is his supervisor. Mora and Wieters use the Grinold and Kroner model to forecast equity market performance.

Macroeconomic forecasts and capital market expectations for three countries are given below:

Mora is also examining the return on federal government bills and bonds of various maturities for the country of Linden.

The data are provided below:

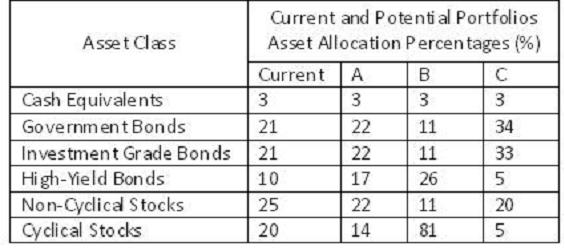

One of Otterbein Forecasting's largest clients is an institutional investor in Linden, the Balduvi Endowment.

The current and potential asset allocations for the endowment are shown below

Mora asks Wieters for his opinion on the future of the economy in Linden and the appropriate investment

for the Balduvi Endowment.

Mora has been asked by the Otterbein CEO to develop a model for explaining stock returns. In her master's degree training, Mora was instructed that the default risk premium has predictive power for stock returns, however the CEO has asked her to include other macroeconomic variables.

Mora examines the following data for the capital market history of Bergamo:

• Default risk premiums, which she measures as the difference in yields between high-yield bonds and government bonds;

• Maturity risk premiums, which she measures as the difference in yields between ten-year and one-year government bonds; and

• Lagged changes in the stock market.

Mora uses these variables to explain stock returns in the following year.

Using 40 years of data, she finds the following results for the significance of the variables in explaining stock returns:

Mora concludes from the correlation analysis that, of the three variables studied, the default risk premium has the most predictive power for stock returns.

As the most recent hire at Otterbein Forecasting, Wieters is well versed on the latest evidence on asset pricing and financial engineering.

However, Mora suspects that his limited experience results in erroneous forecasts.

For instance, during the credit crisis of 2007-2008, annual stock returns in Lombardo averaged -12.6%.

However, using the 80-year history of its capital market, annual stock returns in Lombardo have averaged 13.6%. For his clients' strategic asset allocations in 2010 and onward, Wieters projects Lombardo stock returns of 6.5%. As his supervisor, Mora questions him about this and she suggests that Wieters revise his projections upward.

Mora and Wieters are discussing the valuation and risk analysis of emerging market securities and economies. In their discussion, Mora makes the following comments:

Statement 1: "Emerging countries are dependent on foreign financing of growth, but it is important that a country not take on too much debt. A financial crisis can lead to currency devaluations and capital flight. Foreign debt levels greater than 50% of GDP or debt greater than 200% of current account receipts may indicate that a country is over-levered."

Statement 2: "In financial crises, emerging market debt is particularly susceptible, as currency devaluations will quickly reduce the principal and coupon value. Because most emerging debt is denominated in a domestic currency, the emerging government must have foreign currency reserves to defend its currency in the foreign exchange markets."

What does the bond data predict for the future of the economy in Linden?

Leave a Reply