91. The Wyroman International Pension Fund includes a $65 million fixed-income portfolio managed by Susan Evermore, CFA, of Brighton Investors. Evermore is in the process of constructing a binomial interest-rate tree that generates arbitrage-free values for on-the-run Treasury securities. She plans to use the tree to value more complex bonds with embedded options. She starts out by observing that the yield on a one-year Treasury security is 4.0%. She determines in her initial attempt to price the two-year Treasury security that the value derived from the model is higher than the Treasury security's current market price.

After several iterations Evermore determines that the interest rate tree that correctly values the one and two-year Treasury securities has a rate of 5.0% in the lower node at the end of the first year and a rate of 7.5% in the upper node at the end of the first year. She uses this tree to value a two-year 6% coupon bond with annual coupon payments that is callable in one year at 99.50. She determines that the present value at the end of the first year of the expected value of the bond's remaining cash flows is $98.60 if the interest rate is 7.5% and $100.95 if the interest rate is 5.0%.

Note: Assume Evermore's calculations regarding the two-year 6% callable bond are correct

Evermore also uses the same interest rate tree to price a 2-year 6% coupon bond that is putable in one year, and value the embedded put option. She concludes that if the yield volatility decreases unexpectedly, the value of the putable bond will increase and the value of the embedded put option will also increase, assuming all other inputs are unchanged.

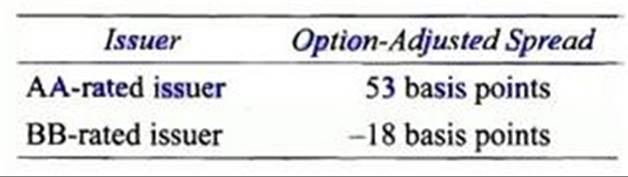

Evermore also uses the interest rate tree to estimate the option-adjusted spreads of two additional callable corporate bonds, as shown in the following figure.

Evermore concludes, based on this information, that the A A-rated issue is undervalued, and the BB-rated issue is overvalued.

At a subsequent meeting with the trustees of the fund. Evermore is asked to explain what a binomial interest rate model is and how it was used to estimate effective duration and effective convexity. Evermore is uncertain of the exact methodology because the actual calculations were done by a junior analyst, but she tries to provide the trustees with a reasonably accurate step-by-stcp description of the process:

Step 1: Given the bond's current market price, the on-the-run Treasury yield curve, and an assumption about rate volatility, create a binomial interest rate tree.

Step 2: Add 100 basis points to each of the 1-year rates in the interest rate tree to derive a "modified" tree.

Step 3: Compute the price of the bond if yield increases by 100 basis points using this new tree.

Step 4: Repeat Steps 1 through 3 to determine the bond price that results from a 100 basis point decrease in rates.

Step 5: Use these two price estimates, along with the original market price, to calculate effective duration and effective convexity.

Lucas Davenport, a trustee and university finance professor, immediately speaks up to disagree with Evermore. He claims that a more accurate description of the process is as follows:

Step 1: Given the bond's current market price, the Treasury yield curve, and an assumption about rate volatility, create a binomial interest rate tree and calculate the bond's option-adjusted spread (OAS) using the model.

Step 2: Impose a parallel upward shift in the on-the-run Treasury yield curve of 100 basis points.

Step 3: Build a new binomial interest rate tree using the new Treasury yield curve and the original rate volatility assumption.

Step 4: Add the OAS from Step I to each of the 1-year rates on the tree to derive a "modified" tree.

Step 5: Compute the price of the bond using this new tree.

Step 6: Repeat Steps 1 through 5 to determine the bond price that results from a 100 basis point decrease in rates.

Step 7: Use these two price estimates, along with the original market price, to calculate effective duration and effective convexity.

At the meeting with the trustees. Evermore also presents the results of her analysis of the effect of changing market volatilities on a 1-year convertible bond issued by Highfour Corporation. Each bond is convertible into 25 shares of Highfour common stock. The bond is also callable at 110 at any time prior to maturity. She concludes that the value of the bond will decrease if either (1) the volatility of returns on'Highfour common stock decreases or (2) yield volatility decreases.

Davenport immediately disagrees with her by saying "changes in the volatility of common stock returns will have no effect on the value of the convertible bond, and a decrease in yield volatility will result in an increase in the value of the bond."

For this question, analyze each effect separately. Is Davenport correct in disagreeing with Evermore's conclusions regarding the effect on the value of the convertible bond resulting from a change in volatility?

Leave a Reply